Multi-Signature Treasuries

Multi-signature Native scripts are one of the most secure ways of managing funds on the Cardano blockchain. Current use cases range from personal backups, trusts, or “fail-safes,” to subDAOs, guilds, working groups, investment clubs, hedge funds, p2p swaps, and even multi-player betting or gambling games. And that’s only scratching the surface. In the future, we expect to see many new and exciting use cases that benefit from this simple yet secure scripting language.

Benefits:

- Set up advanced multi-signature treasuries with only a few clicks.

- Add signers/key holders with only their receive address. (or $ADAHandle)

- Set script parameters for spending.

- Highly secure, leverages Cardano layer 1 security.

- Users never give up custody.

- ADA Handle integration for easy creation, tracking and verifiability.

Cardano Native Scripts allow for you to specify a number of different validation criteria for a particular Cardano address. Time locks, minting policies, and the requiring of multiple witnesses or signers are all configurable parameters for Cardano Native Scripts. Requiring multiple witnesses or signers gives us the ability to distribute spending authority to more than one person or amongst multiple keys.

The Summon multi-signature treasury system focuses heavily on user friendliness and easy treasury management. The interface allows you to assign signers/key holders by simply inputting their Cardano receiving address or by resolving their $ADAHandle directly in the UI.

Create a multi-sig treasury

The Summon multi-signature treasury system requires no coding experience and is compatible with all popular Cardano lite wallets. Creating a new treasury is simple:

- Start with a name, e.g. test_treasury.

- Next, add signers by entering their receiving address or associated $ADAHandle.

- Set the parameters for how many of those key holders must sign the transactions for them to be considered “valid.” (e.g. 2 of 3, 3 of 5, etc.)

Once the list of key holders is complete and the spending requirements are set, simply save and share your new treasury address with all the other signers/key holders.

Creating multiple specialized guilds or sub-groups within a larger organization is just one example use case for this versatile asset management system.

When you create a multi-signature treasury, you are distributing the spending authority to multiple key pairs (wallets). This can be configured in many different ways but basically you are just saying that more than one key/wallet owner has to sign the transaction in order for it to be valid.

This scalable security could look like 1 out of 3, 3 out of 5, 6 out of 9, and so on. The only limits are Cardano transaction size and human coordination. It can be quite a task to get 10+ people coordinated in a short amount of time, though this isn’t an issue for committed and active teams.

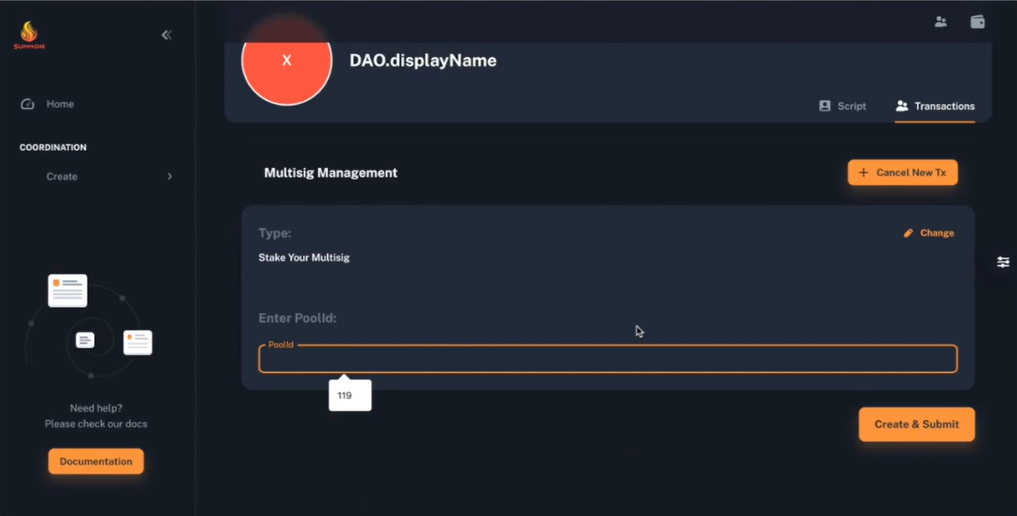

Multi-Sig Staking & more

Other key features include easy treasury staking (as depicted in the below image), easy asset selection, and the ability to construct (or build) custom transactions that contain multiple fungible and/or non-fungible tokens as well as “multi-recipient” transactions which contain multiple outputs going to multiple unique addresses.

Unlike RoundTable (the popular multi-signature Dapp developed by the ADAO Community), which is built on the CML and leverages gun.js for coordination, the Summon multi-signature application is built on Lucid and leverages the Summon Platform infrastructure for coordination of signatures. This is an important design feature to note, as it allows users the same self-sovereignty and ownership over their treasuries that they are used to and have come to expect with RoundTable, while also providing the reliability of the enterprise-grade infrastructure offered by the Summon Platform. That being said, it is important to understand the responsibilities that come with securing a multi-signature treasury on Cardano.

Just like securing a personal wallet, there are some best practices you will want to always follow. Here is an article by our friends at the ADAO Community that goes into detail on some of those best practices.

In the near future, the Summon team plans to implement “generic” Native scripts that can be configured directly through the Summon UI. The use cases for these generic Native scripts are arguably endless: setting up family trusts and time-locked savings accounts are two known use cases, and while examples and educational articles will be a top priority of the Summon team, we are excited to see where the community takes this.